Our Products & Services

Getting Started

First Time Setup

Getting Started With Jobs

Getting Started with Accounts

Getting Started with Inventory

Getting Started with Ticketing

Setting Sonar up for Billing

Baseline Configuration

How To: Using Sonar's Customer Portal

User Specific Resources

Accounts

Account Groups: Overview & Example Use Cases

Account List View: Overview

Account Management View: Overview

Account Overview Customization

Account Statuses: Overview & Example Use Cases

Account Types: Overview & Example Use Cases

Anchor & Linked Serviceable Addresses: Overview and Best Practices

Archiving an Account: Overview

CPUC Fixed Broadband Deployment by Address

Child Accounts: Best Practices & How Tos

Creating a New Account

Direct Messages: Overview

Disconnecting an Account

Disconnection Reason Management: Overview

Exploring Task Groups

FCC Broadband Data Collection (BDC) Filings: How Sonar Can Help

FCC Data Exports: General Overview and Usage

Future Serviceable Addresses: Overview

Lead Intake Form Processing

Notes: Best Practices & Use Cases

Scheduled Events: Overview & Use Cases

Serviceable Addresses: Overview and Usage

Specify Account ID upon Creation

Tasks & Task Templates: Overview

Using Sonar's FCC Broadband Label Generation Tool

Billing

ACH Batching: Overview

Accounts in Vacation Mode

Avalara: Overview & Setup

Batch Payments & Deposit Slips: Overview

Billing Calculator

Billing Defaults

Billing Settings

Building Packages

Building a Data Service

Canadian ACH tool

Changing Service Pricing in Sonar: Best Practices

Considerations When Using Avalara with Voice Services

Creating Discounts for Services and Packages

Delinquency Billing Best Practices

Delinquency Exclusions: Overview and Use Cases

Dual Data Services: Overview

Email Invoice Batch: Overview

General Ledger Codes: Overview

General Transactions: Best Practices

How Sonar Prorates Billing

How to Take Bank Account Payments

How to: Adding a Service to an Account

Invoice Templates: Overview

Leveraging PayPal as a Payment Method in Sonar

Manual Transactions

Multi-Month Billing & Multi-Month Services

Print to Mail

Printed Invoice Batches: Overview

Services: Overview

Setting Up Payment Methods and Taking Payments

Setting up Bank Account & Credit Card Processors

Taxes Setup

Usage Based Billing Policies: Overview and Usage

Usage Based Billing Policy Free Periods: Overview and Usage

Using Tax Exemptions - How To

Communication

Communications: Call Logs Overview & Best Practices

Communications: Messages Overview

Email Variables & Conditions

Message Categories: Overview & Use Cases

Phone Number Types: Overview and Use Cases

Saved Messages: Overview

Setting up an Outbound Email Domain

Trigger Explanations

Triggered Messages: Setup

Using Outbound SMS

Using the Mass Message Tool

Companies

How to: Setting Up a Company in Sonar

Managing Multiple Companies in Sonar: Best Practices

Rebranding your Sonar Instance

Financial

Contract Templates

Invoice Attachment Use Cases & PDF Examples

Invoice Messages: Overview & Use Cases

Invoices in Sonar: Examples, Creation & Contents

Integrations

Atlas Digital CORE Integration

Calix Cloud Data Field Mappings

Calix SMx Integration: Overview

CrowdFiber Integration

External Marketing Providers

GPS Tracking Providers: Overview

GoCardless Integration: Overview & Setup

How to Connect Cambium to your Sonar Instance

How to Connect Preseem to your Sonar System

How to: Using Webhooks in Sonar

Integrating with Calix Cloud

RemoteWinBox - Integration with Sonar

Sonar Retain: AI-Powered Customer Retention & Quality Intelligence

The Sonar Field Tech App

Tower Coverage Integration: Overview

VETRO FiberMap V2 Integration: Overview

VETRO FiberMap V3 Integration: Overview

Webhooks in Sonar: Basic PHP Example

iCalendar Integration

Inventory

Inventory List View: Overview

Inventory Model Management: General Overview

Network Inventory: How-to & Usage Guide

Segmentable Inventory: How-to & Usage Guide

Setup of Inventory: Manufacturers, Categories, and Assignees

Tracking and Using Consumable Inventory

Jobs

Applying Task Templates to Jobs

Edit Job Options

Example Jobs & Templates

Geofences: Overview

Job Types: Best Practices

Jobs and Scheduling: Overview

Scheduling Dispatcher View: Overview

Scheduling How-to: Creating and Booking a Job

Scheduling Table View: Overview

Scheduling Week View: Overview

Setting Up Schedules General Overview

Mapping

Misc.

Combining Custom Fields & Task Templates for Information Storage

Custom Fields Overview & Use Cases

Custom Links: Overview

Task Templates Overview & Use Cases

Monitoring

Building Alerting Rotations

Building a Monitoring Template

Poller Troubleshooting

Pollers: General Overview, Deployment Strategy, Build Out & Setup

Networking

Adtran Mosaic Cloud Platform Integration: Overview

Assigning RADIUS Addresses

Assigning an IP Address Using Sonar's IPAM: How to

Automating IP Assignments, Data Rates, and Network Access in Sonar

Building Address Lists

Building RADIUS Groups

Building a Device Mapper

Cable Modem Provisioning

Controlling Customer Speeds with Sonar: General Overview

DHCP Delivery

Data Usage Available Methods

Finding your OIDs

FreeRADIUS 3: Build-Out & Integration

How Sonar Communicates - Egress IPs Explained

IP Assignments & Sonar

IPAM: Basic Setup

IPAM: Overview

LTE Integration

MikroTik as an Inline Device: Integration With Sonar

MikroTik: Controlling Access

MikroTik: Controlling Speeds

MikroTik: Setting Up a Sonar Controlled DHCP Server

Netflow On-Premise Integration: Setup and Overview

Network Dashboard: Overview

Network Sites: Management View Overview

PacketLogic: Integration With Sonar

Pulse, Polling, and PHP

RADIUS: Build-Out & Integration with Sonar

RADIUS: Building Reply Attributes

Setting Up CoA Proxy

Sonar Flow

Sonar IP Addressing

Using Multiple Network Devices in Sonar

Purchase Orders

Release Notes

Reporting

Enhanced Business Intelligence - Tips & Tricks for Advanced Users

How To Enhance Your Reporting With Custom Field Data

Report Licenses

Sonar's Business Intelligence: Overview

Understanding Sonar Reports

Using Sonar DataConnect to Connect BI Applications with Your Sonar Instance

Security

Application Firewall: General Overview and Best Practices

Auth0: Overview

Multi-Factor Authentication: Overview

Password Policy In Depth

Removing a Terminated Employee In Sonar

Role Creation using GraphiQL

User Role Creation & Best Practices

Users: Overview

Sonar Billing

sonarPay

sonarPay Canada Disbursements: Overview

sonarPay Chargebacks & Disputes: Overview

sonarPay Disbursements: Overview

sonarPay Monthly Statement: Overview

sonarPay Overview

sonarPay Reversals, Voids, & Refunds: Overview

sonarPay: Token Migration Process

System

A Deeper Dive into the New Sonar API

API Calls Using Third Party Applications: Personal Access Tokens

Browser Compatibility and Minimum Hardware Requirements for Sonar

Consuming the Sonar API

Controlling Your Landing Page: Personal Preferences

Customizing Your Customer Portal

Date/Time Picker: Overview

Dynamic Time Zones in Sonar

Filtering: Overview

Frequently Used Terms

Getting Your Data into Sonar

GraphQL Rate Limiting Overview

How To Use GraphiQL to Understand the Sonar API

How Your Data is Backed Up

How to Best Use Global Search

Interacting with Files via the API

Introducing the New Sidebar

Main Menu: Overview

Mutations in the Sonar API

Notification Preferences

REST API Wrappers for V1 Compatibility

SMS Notifications

Sonar's Rich Text Editor

System Settings: Overview

The New Sonar API

Troubleshooting the Customer Portal

Upgrading your Ubuntu OS - Customer Portal Upgrades

User Profile: Your Personal User Settings

Ticketing

Advanced Ticketing Features

Canned Replies Examples & Templates

Canned Reply Categories

Exploring Ticket Groups

How Sonar Manages Spam Tickets

How to Integrate Inbound Mailboxes with Slack

Inbound Mailboxes Example Build

Ticket Category Families & Ticket Categories: Overview

Ticket Resolution Reasons: Overview

Ticketing: Overview

Using Parent Tickets

Voice

API Changes for Voice Billing

Best Practices to Remain CPNI Compliant

Billing Voice Services in Sonar

Deploying Voice Services in Sonar

Working With the Sonar Team & Additional Resources

Sonar's Security Practices & Certifications

Sonar and General Data Protection Regulation (GDPR)

Sonar's Security Strategies

Technical Security Overview

Best Practices for Fast Tracking a Support Request

Feedback Portal / Suggest a Feature

Learning with Sonar: Tools and Resources

New Client Training Overview

Sonar Casts Table of Contents

Submitting Bugs vs. Feature Requests

The Sonar Community Forum

The Sonar Status Page

Third Party Customer Support Referrals

Table of Contents

- All Categories

-

- Sonar Billing, Reporting & Your Accounting Software: V2

Sonar Billing, Reporting & Your Accounting Software: V2

Updated

by Julianna Durie

Read Time: 5 mins

Sonar Billing & Your Accounting Software

Sonar relates to your accounting software as if it is one single client. Typically, you do the following with this one client within that software:

- Sell services

- Charge and collect taxes

- Receive, full, partial, and advance payments via credit card, bank, checks, and cash - some payments are automatic, some are entered manually

- Give refunds

- Create invoices monthly, or as often as you would like

Within Sonar, from an accounting perspective, you will do the following for all of your customers and then combine them into one big customer, by running a daily, weekly or monthly report.

- Sell recurring, one-time, and grouped services

- Charge and collect taxes according to liability for each account or service

- Receive, full, partial, and advance payments via credit card, bank, checks and cash - some payments are automatic, some are entered manually

- Give refunds, apply one-time and expiring discounts

- Create invoices monthly or on a multi-month basis

You can reconcile when you choose to run reports, either daily, weekly or monthly, to ensure your accounting software will match the totals that appear within the Sonar reports. Your accounting software will provide the full picture of your company, with all of the corporate transactions included, such as reconciled sales, accounts receivable, customer deposits, undeposited funds, taxes collected, and taxes due. Sonar will show all of the transactions relating to your customers and be the authoritative system that is broken down to a per-customer level.

Sonar Reporting & Your Accounting Software

Below you will find detailed examples of Sonar reporting, for the current (V2) version of Sonar, as well as how you can use these reports to enter information into your accounting software. For information on general ledger codes and how you can set them up in Sonar, take a look at the General Ledger Codes: Overview article available within the knowledge base.

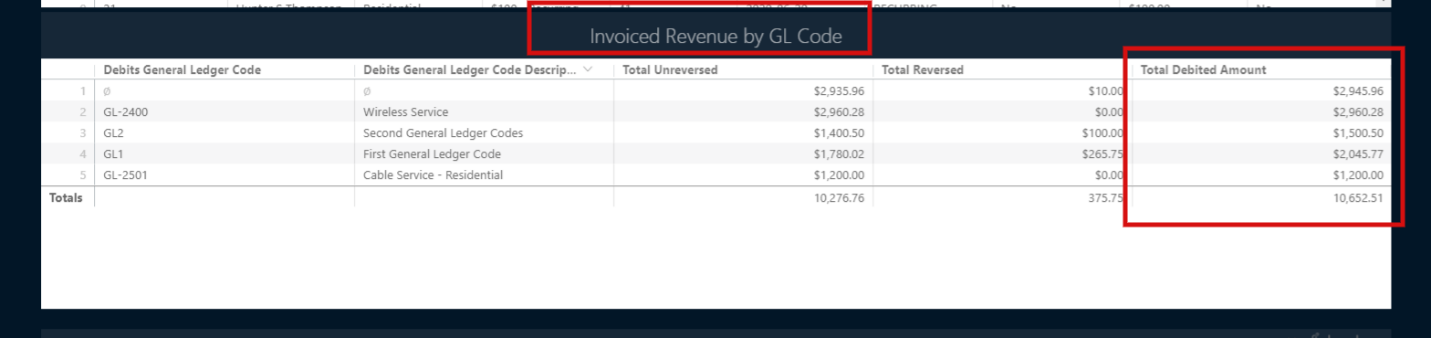

Example #1: Invoiced Revenue

Invoiced Revenue > Invoiced Revenue by GL Code

The “Totals” column is the total invoiced amount in the selected period, split by GL Code.

Example Journal Entries:

Record the Transactions by GL Code > Debits “Total” for each GL Code/ Unassigned as individual journal entries on the Sonar customer account, per general ledger code.

Date | Code | Account | Debit | Credit |

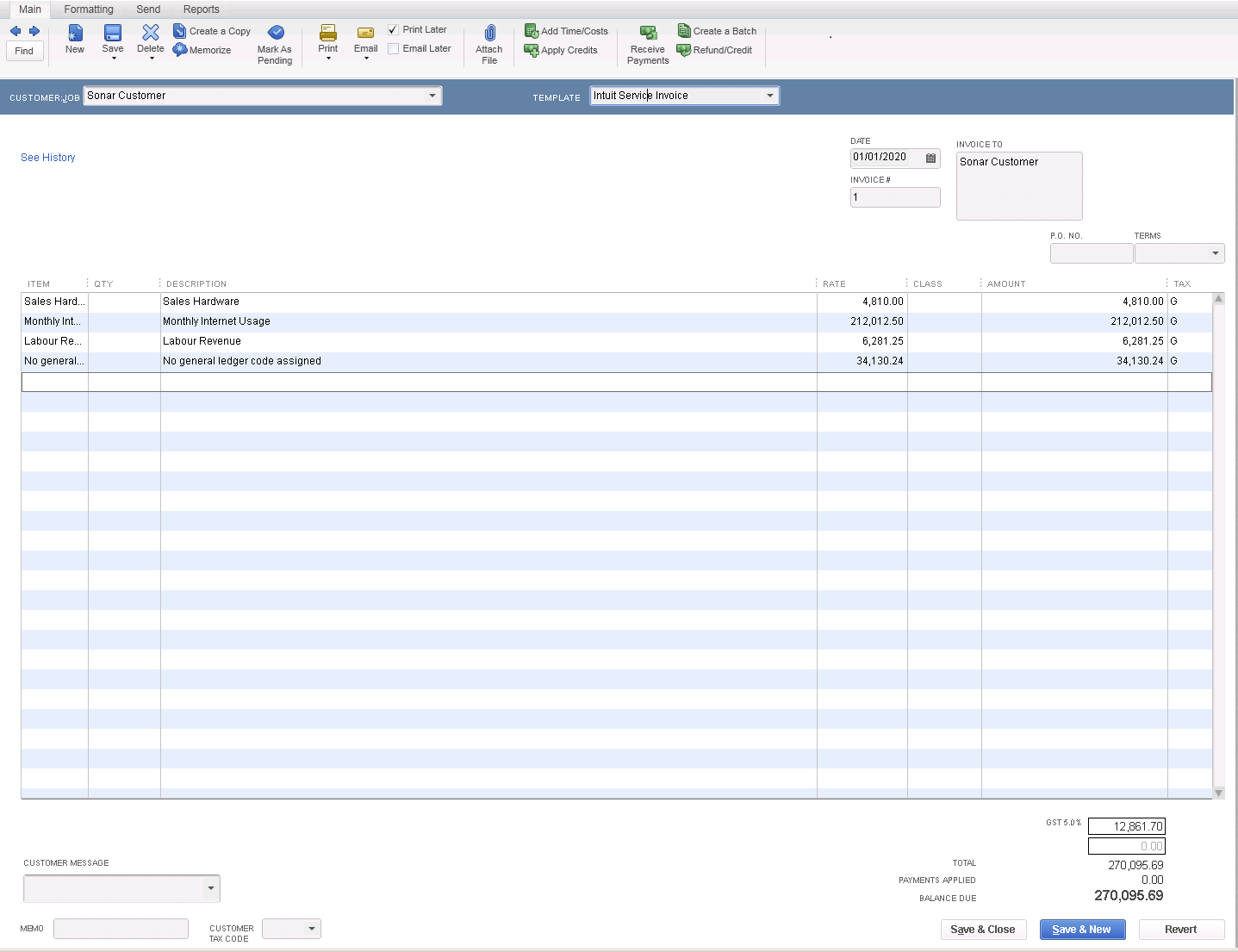

Jan 31 | 48000 | Sales Hardware | $4,810.00 | |

Jan 31 | 48200 | Monthly Internet Usage | $212,012.50 | |

Jan 31 | 48220 | Labour Revenue | $6,281.25 | |

Jan 31 | No general ledger code assigned | N/A | $34,130.24 | |

Jan 31 | N/A | Accounts Receivable | $257,233.99 |

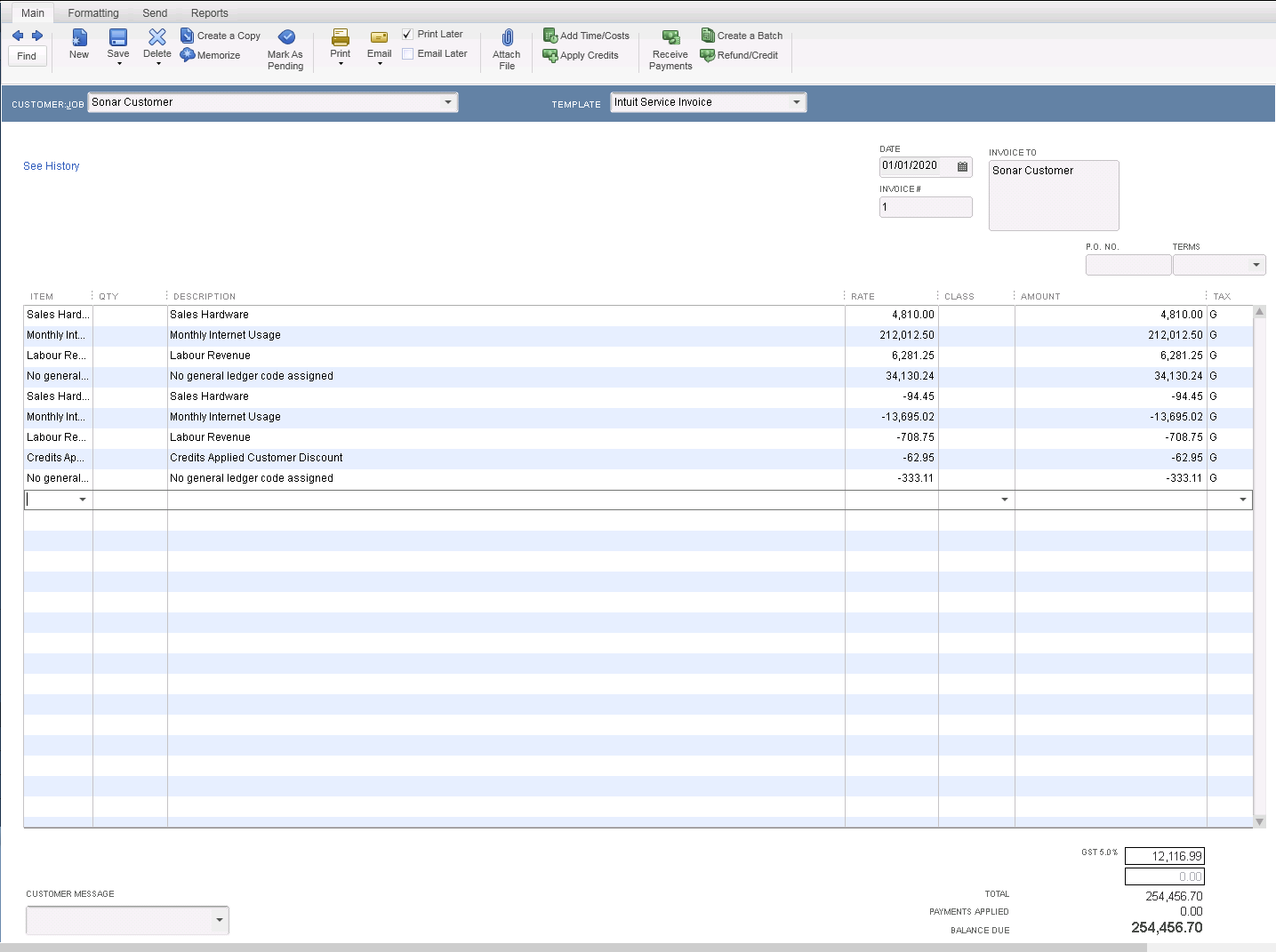

Example Quickbooks Invoice:

Record the Transactions by GL Code > Debits “Total” for each GL Code/ Unassigned as individual line items on an invoice for the Sonar customer account.

Example #2: Discounts

Request a Custom Report for Looker for Discounts by GL

Example Journal Entries:

Record the Transactions by GL Code > Discounts Applied “Total” amount for each GL Code/ Unassigned as individual journal entries, per general ledger code.

Date | Code | Account | Debit | Credit |

Jan 31 | 48000 | Sales Hardware | $94.45 | |

Jan 31 | 48200 | Monthly Internet Usage | $13,695.02 | |

Jan 31 | 48220 | Labour Revenue | $708.75 | |

Jan 31 | 48250 | Credits Applied Customer Discounts | $62.95 | |

Jan 31 | No general ledger code assigned | N/A | $333.11 | |

Jan 31 | N/A | Accounts Receivable | $14,894.28 |

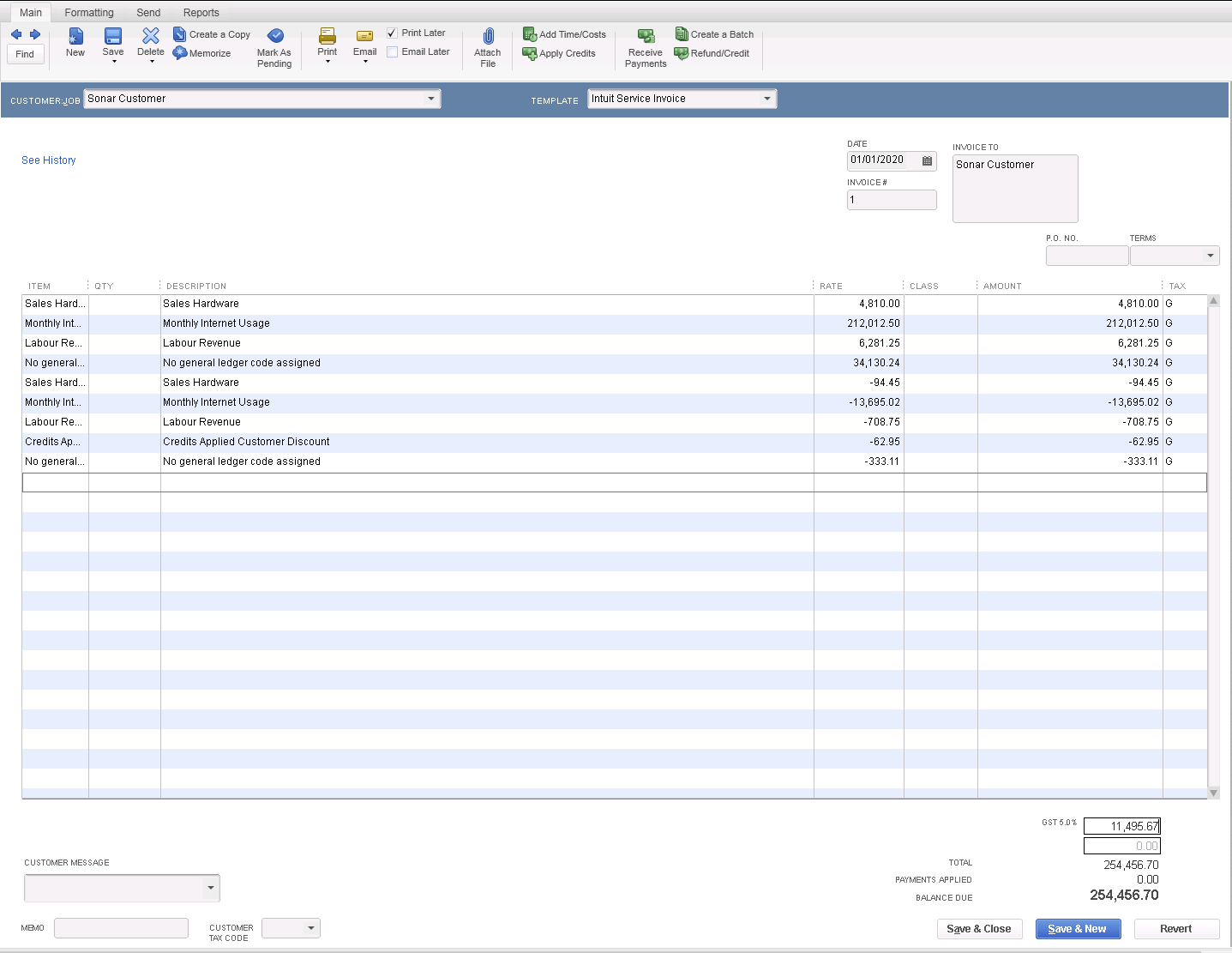

Example Quickbooks Invoice:

Record the Transactions by GL Code > Discounts Applied “Total” for each GL Code/ Unassigned as individual line items on an invoice for the Sonar customer account.

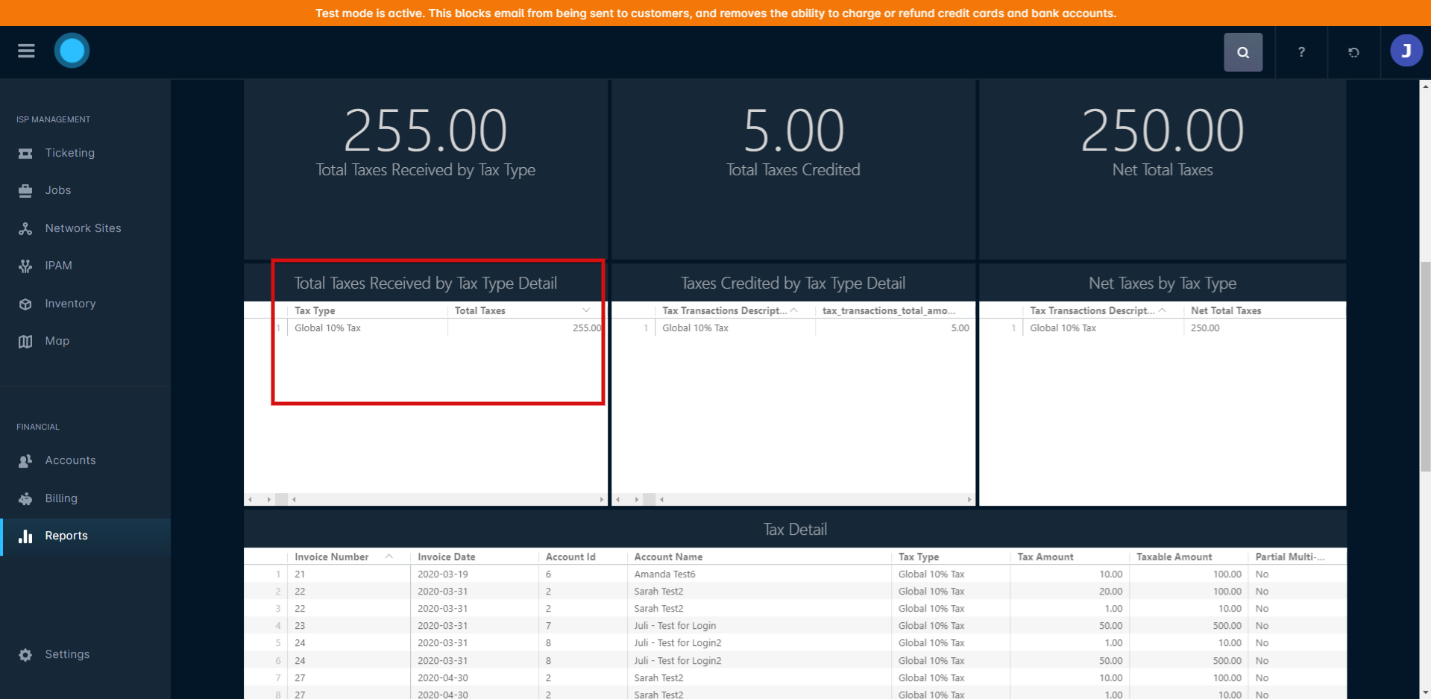

Example #3: Taxes

Taxes

The “Total Taxes Received by Tax Type Detail” here is the total amount of taxes collected for invoices within the period, split by tax type.

Example Journal Entries:

Record the Taxes “Tax” for each tax type per tax type. Also record “Tax Credits” for each tax type. Subtract the tax credits.

Date | Code | Account | Debit | Credit |

Jan 31 | State Tax Payable | $12,363.17 | ||

State Tax Payable | $867.50 | |||

Jan 31 | Accounts Receivable | $11,495.67 |

Example Quickbooks Invoice:

Record the Taxes “Tax” for each tax type per tax type. Also record “Tax Credits” for each tax type. Subtract the tax credits. Adjust the invoice taxes on a per tax type basis.

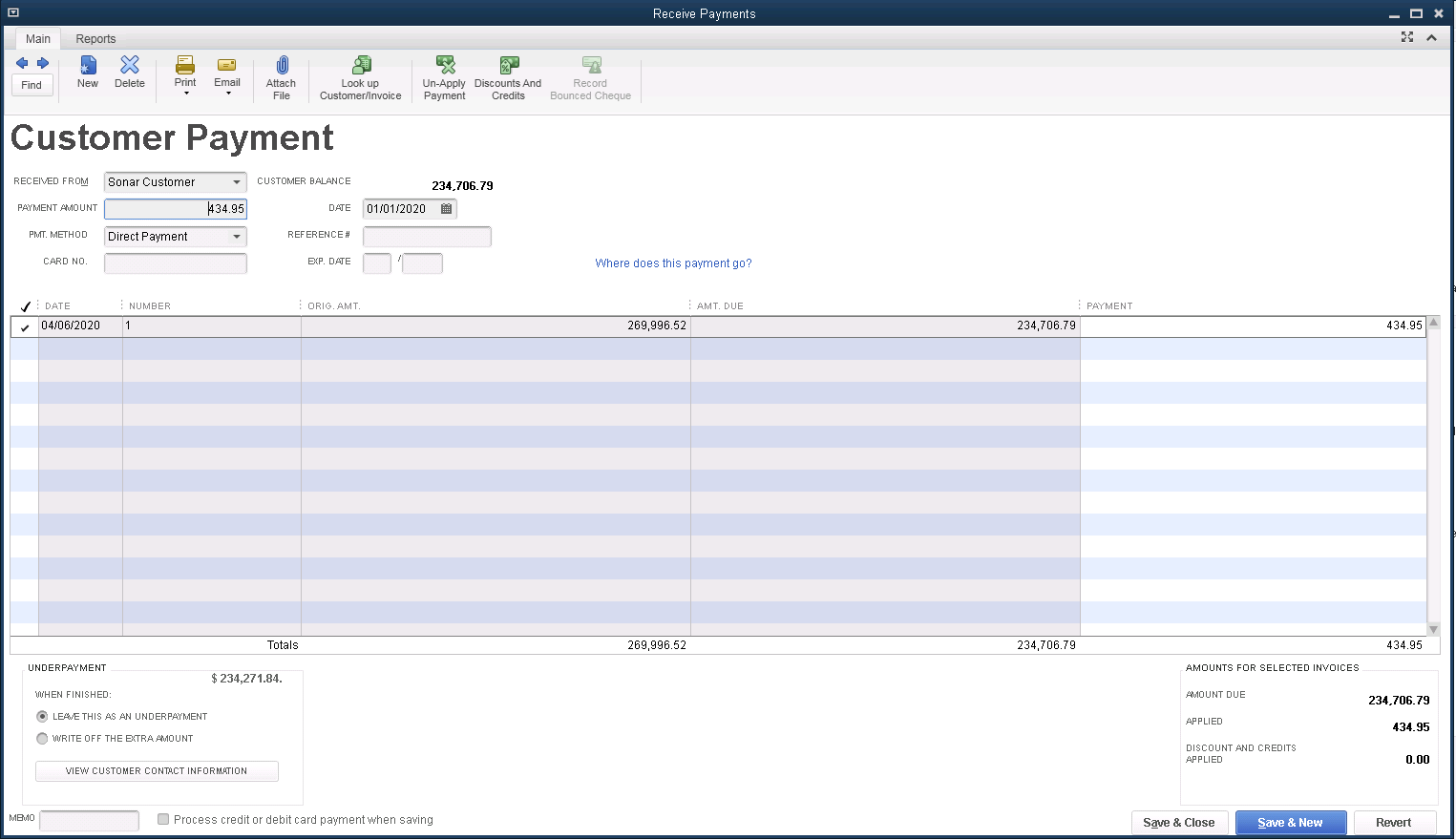

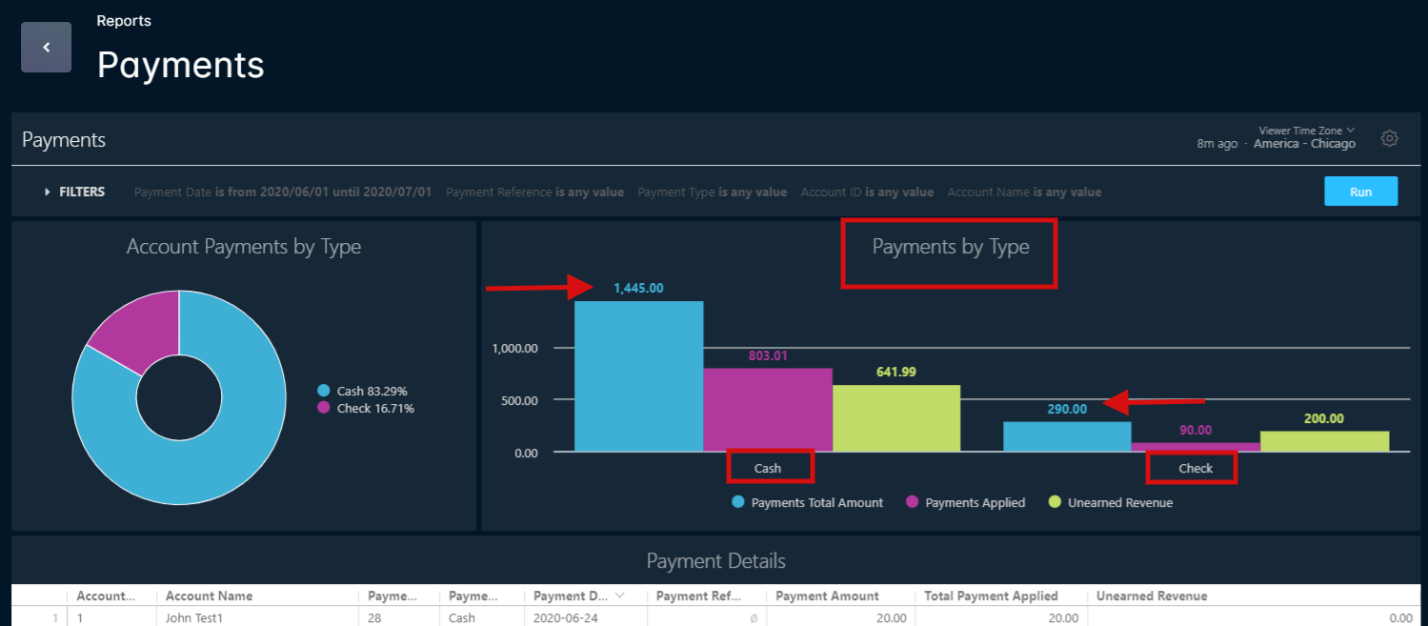

Example #4: Payments

Credits/Payments Applied > Payments by Type > Payments Total Amount (Blue)

“Payments by Type” totals the amount of payments, payments applied, and unearned revenue (unapplied payments) to invoices within the period, split by payment type. For this you want to use “Payments Total Amount”.

Example Journal Entries:

Record the Credits/Payments > Payments “Total” for each Type of Payment into your Journal Entries as individual journal entries per payment type.

Date | Code | Account | Debit | Credit |

Jan 1 | ACH | $22,879.13 | ||

Jan 1 | Credit Card | $12,410.60 | ||

Jan 1 | Wire | $434.95 | ||

Jan 1 | Accounts Receivable | $35,724.68 | ||

Jan 2 | ACH | $325.25 | ||

Jan 2 | Credit Card | $1,577.80 | ||

Jan 2 | Wire | $3,098.82 | ||

Jan 2 | Accounts Receivable | $5,001.87 |

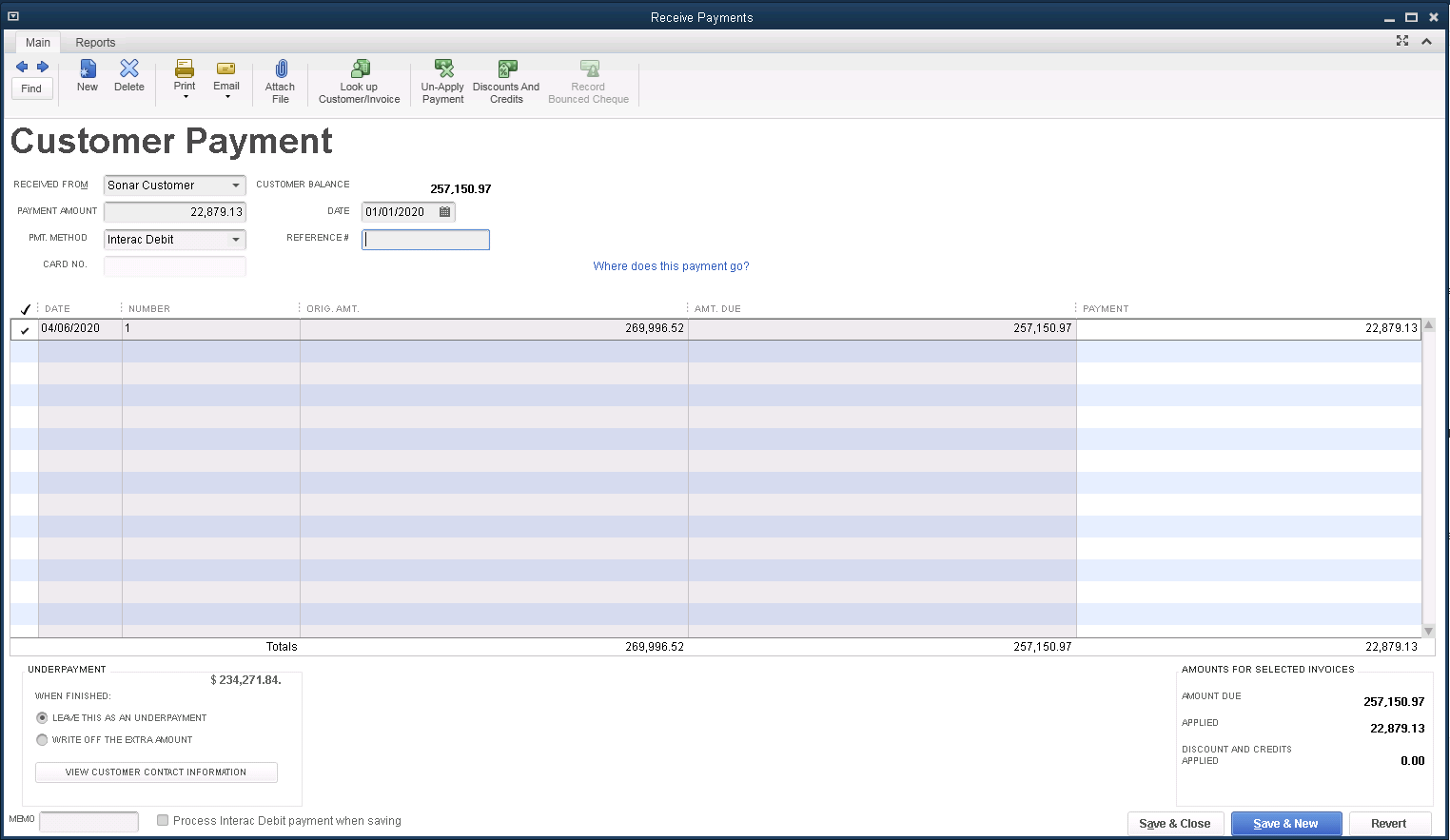

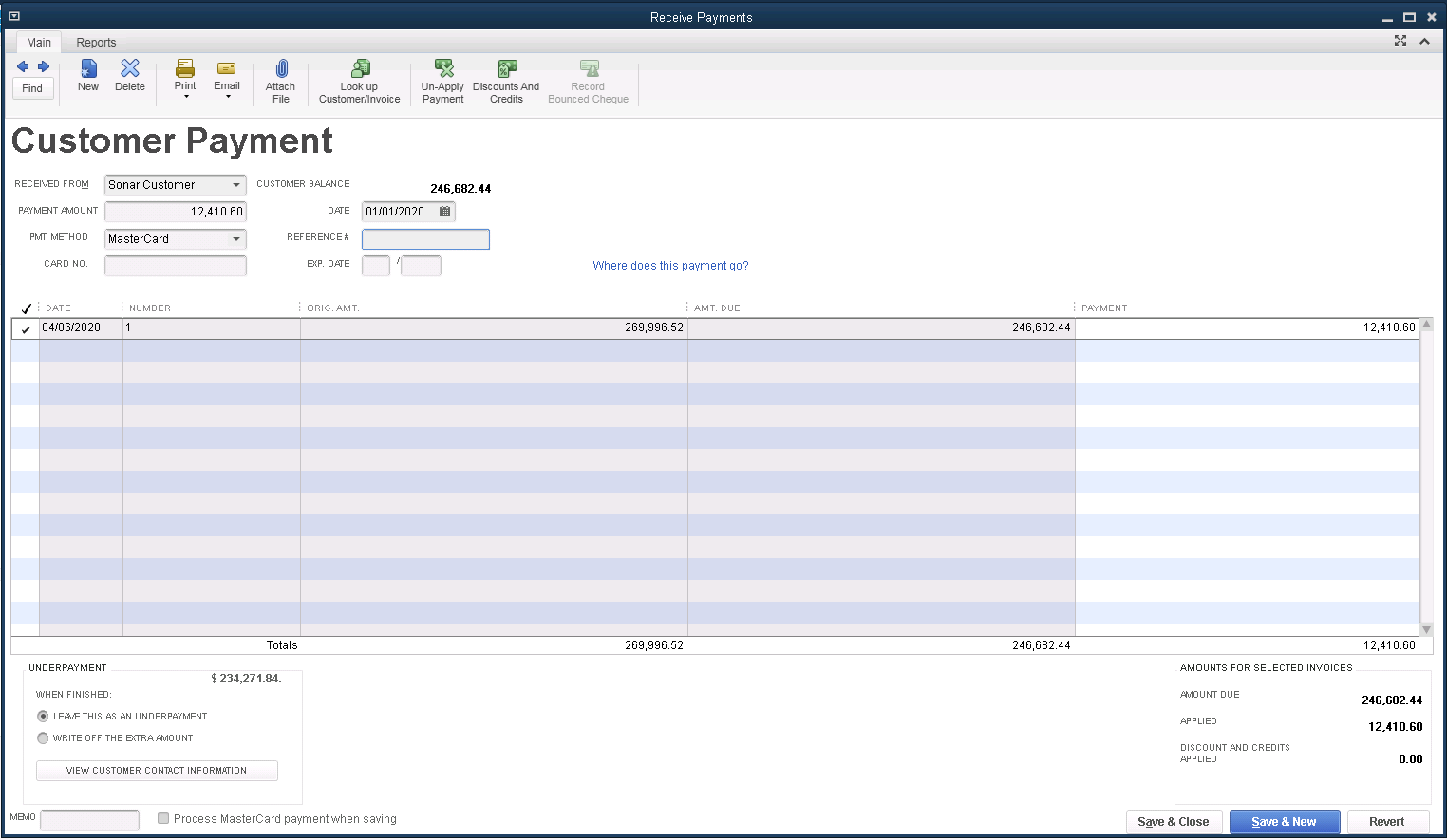

Example Quickbooks Payments:

Record the Credits/Payments > Payments “Total” for each Type of Payment into your Quickbooks payments as individual payment entries per payment type.

Jan 1 ACH

Jan 1 Credit Cards

Jan 1 Wire