Our Products & Services

Getting Started

First Time Setup

Getting Started With Jobs

Getting Started with Accounts

Getting Started with Inventory

Getting Started with Ticketing

Setting Sonar up for Billing

Baseline Configuration

How To: Using Sonar's Customer Portal

User Specific Resources

Accounts

Account Groups: Overview & Example Use Cases

Account List View: Overview

Account Management View: Overview

Account Overview Customization

Account Statuses: Overview & Example Use Cases

Account Types: Overview & Example Use Cases

Anchor & Linked Serviceable Addresses: Overview and Best Practices

Archiving an Account: Overview

CPUC Fixed Broadband Deployment by Address

Child Accounts: Best Practices & How Tos

Creating a New Account

Direct Messages: Overview

Disconnecting an Account

Disconnection Reason Management: Overview

Exploring Task Groups

FCC Broadband Data Collection (BDC) Filings: How Sonar Can Help

FCC Data Exports: General Overview and Usage

Future Serviceable Addresses: Overview

Lead Intake Form Processing

Notes: Best Practices & Use Cases

Scheduled Events: Overview & Use Cases

Serviceable Addresses: Overview and Usage

Specify Account ID upon Creation

Tasks & Task Templates: Overview

Using Sonar's FCC Broadband Label Generation Tool

Billing

ACH Batching: Overview

Accounts in Vacation Mode

Avalara: Overview & Setup

Batch Payments & Deposit Slips: Overview

Billing Calculator

Billing Defaults

Billing Settings

Building Packages

Building a Data Service

Canadian ACH tool

Changing Service Pricing in Sonar: Best Practices

Considerations When Using Avalara with Voice Services

Creating Discounts for Services and Packages

Delinquency Billing Best Practices

Delinquency Exclusions: Overview and Use Cases

Dual Data Services: Overview

Email Invoice Batch: Overview

General Ledger Codes: Overview

General Transactions: Best Practices

How Sonar Prorates Billing

How to Take Bank Account Payments

How to: Adding a Service to an Account

Invoice Templates: Overview

Leveraging PayPal as a Payment Method in Sonar

Manual Transactions

Multi-Month Billing & Multi-Month Services

Print to Mail

Printed Invoice Batches: Overview

Services: Overview

Setting Up Payment Methods and Taking Payments

Setting up Bank Account & Credit Card Processors

Taxes Setup

Usage Based Billing Policies: Overview and Usage

Usage Based Billing Policy Free Periods: Overview and Usage

Using Tax Exemptions - How To

Communication

Communications: Call Logs Overview & Best Practices

Communications: Messages Overview

Email Variables & Conditions

Message Categories: Overview & Use Cases

Phone Number Types: Overview and Use Cases

Saved Messages: Overview

Setting up an Outbound Email Domain

Trigger Explanations

Triggered Messages: Setup

Using Outbound SMS

Using the Mass Message Tool

Companies

How to: Setting Up a Company in Sonar

Managing Multiple Companies in Sonar: Best Practices

Rebranding your Sonar Instance

Field Tech App

Financial

Contract Templates

Invoice Attachment Use Cases & PDF Examples

Invoice Messages: Overview & Use Cases

Invoices in Sonar: Examples, Creation & Contents

Integrations

Atlas Digital CORE Integration

Calix Cloud Data Field Mappings

Calix SMx Integration: Overview

CrowdFiber Integration

External Marketing Providers

GPS Tracking Providers: Overview

GoCardless Integration: Overview & Setup

How to Connect Cambium to your Sonar Instance

How to Connect Preseem to your Sonar System

How to: Using Webhooks in Sonar

Integrating with Calix Cloud

RemoteWinBox - Integration with Sonar

Sonar Retain: AI-Powered Customer Retention & Quality Intelligence

Tower Coverage Integration: Overview

VETRO FiberMap V2 Integration: Overview

VETRO FiberMap V3 Integration: Overview

Webhooks in Sonar: Basic PHP Example

iCalendar Integration

Inventory

Inventory List View: Overview

Inventory Model Management: General Overview

Network Inventory: How-to & Usage Guide

Segmentable Inventory: How-to & Usage Guide

Setup of Inventory: Manufacturers, Categories, and Assignees

Tracking and Using Consumable Inventory

Jobs

Applying Task Templates to Jobs

Edit Job Options

Example Jobs & Templates

Geofences: Overview

Job Types: Best Practices

Jobs and Scheduling: Overview

Scheduling Dispatcher View: Overview

Scheduling How-to: Creating and Booking a Job

Scheduling Table View: Overview

Scheduling Week View: Overview

Setting Up Schedules General Overview

Mapping

Misc.

Combining Custom Fields & Task Templates for Information Storage

Custom Fields Overview & Use Cases

Custom Links: Overview

Task Templates Overview & Use Cases

Monitoring

Building Alerting Rotations

Building a Monitoring Template

Poller Troubleshooting

Pollers: General Overview, Deployment Strategy, Build Out & Setup

Networking

Adtran Mosaic Cloud Platform Integration: Overview

Assigning RADIUS Addresses

Assigning an IP Address Using Sonar's IPAM: How to

Automating IP Assignments, Data Rates, and Network Access in Sonar

Building Address Lists

Building RADIUS Groups

Building a Device Mapper

Cable Modem Provisioning

Controlling Customer Speeds with Sonar: General Overview

DHCP Delivery

Data Usage Available Methods

Finding your OIDs

FreeRADIUS 3: Build-Out & Integration

How Sonar Communicates - Egress IPs Explained

IP Assignments & Sonar

IPAM: Basic Setup

IPAM: Overview

LTE Integration

MikroTik as an Inline Device: Integration With Sonar

MikroTik: Controlling Access

MikroTik: Controlling Speeds

MikroTik: Setting Up a Sonar Controlled DHCP Server

Netflow On-Premise Integration: Setup and Overview

Network Dashboard: Overview

Network Sites: Management View Overview

PacketLogic: Integration With Sonar

Pulse, Polling, and PHP

RADIUS: Build-Out & Integration with Sonar

RADIUS: Building Reply Attributes

Setting Up CoA Proxy

Sonar Flow

Sonar IP Addressing

Using Multiple Network Devices in Sonar

Purchase Orders

Release Notes

Reporting

Enhanced Business Intelligence - Tips & Tricks for Advanced Users

How To Enhance Your Reporting With Custom Field Data

Report Licenses

Sonar's Business Intelligence: Overview

Understanding Sonar Reports

Using Sonar DataConnect to Connect BI Applications with Your Sonar Instance

Security

Application Firewall: General Overview and Best Practices

Auth0: Overview

Multi-Factor Authentication: Overview

Password Policy In Depth

Removing a Terminated Employee In Sonar

Role Creation using GraphiQL

User Role Creation & Best Practices

Users: Overview

Sonar Billing

sonarPay

sonarPay Canada Disbursements: Overview

sonarPay Chargebacks & Disputes: Overview

sonarPay Disbursements: Overview

sonarPay Monthly Statement: Overview

sonarPay Overview

sonarPay Reversals, Voids, & Refunds: Overview

sonarPay: Token Migration Process

System

A Deeper Dive into the New Sonar API

API Calls Using Third Party Applications: Personal Access Tokens

Browser Compatibility and Minimum Hardware Requirements for Sonar

Consuming the Sonar API

Controlling Your Landing Page: Personal Preferences

Customizing Your Customer Portal

Date/Time Picker: Overview

Dynamic Time Zones in Sonar

Filtering: Overview

Frequently Used Terms

Getting Your Data into Sonar

GraphQL Rate Limiting Overview

How To Use GraphiQL to Understand the Sonar API

How Your Data is Backed Up

How to Best Use Global Search

Interacting with Files via the API

Introducing the New Sidebar

Main Menu: Overview

Mutations in the Sonar API

Notification Preferences

REST API Wrappers for V1 Compatibility

SMS Notifications

Sonar's Rich Text Editor

System Settings: Overview

The New Sonar API

Troubleshooting the Customer Portal

Upgrading your Ubuntu OS - Customer Portal Upgrades

User Profile: Your Personal User Settings

Ticketing

Advanced Ticketing Features

Canned Replies Examples & Templates

Canned Reply Categories

Exploring Ticket Groups

How Sonar Manages Spam Tickets

How to Integrate Inbound Mailboxes with Slack

Inbound Mailboxes Example Build

Ticket Category Families & Ticket Categories: Overview

Ticket Resolution Reasons: Overview

Ticketing: Overview

Using Parent Tickets

Voice

API Changes for Voice Billing

Best Practices to Remain CPNI Compliant

Billing Voice Services in Sonar

Deploying Voice Services in Sonar

Working With the Sonar Team & Additional Resources

Sonar's Security Practices & Certifications

Sonar and General Data Protection Regulation (GDPR)

Sonar's Security Strategies

Technical Security Overview

Best Practices for Fast Tracking a Support Request

Feedback Portal / Suggest a Feature

Learning with Sonar: Tools and Resources

New Client Training Overview

Sonar Casts Table of Contents

Submitting Bugs vs. Feature Requests

The Sonar Community Forum

The Sonar Status Page

Third Party Customer Support Referrals

Table of Contents

- All Categories

- Billing

- How to Take Bank Account Payments

How to Take Bank Account Payments

Read Time: 3 mins

When configuring your instance to accept and process bank transfers from customer accounts to you in Sonar, there are three options available: ACH, eCheck, or Wire. Each option is discussed further below, including diagrams of how the money flows in each situation and what you can expect when interacting with them.

ACH

ACH is a cheaper but more manual method, as when you process bank transfers as ACH, you must generate the batch file from within Sonar and provide it to your bank for processing. You also must manually reconcile all failures, since Sonar assumes the ACH transaction is valid, unless otherwise told.

For more information on ACH batches, take a look at the ACH Batching: Overview article here.

How the Money Moves

Considerations

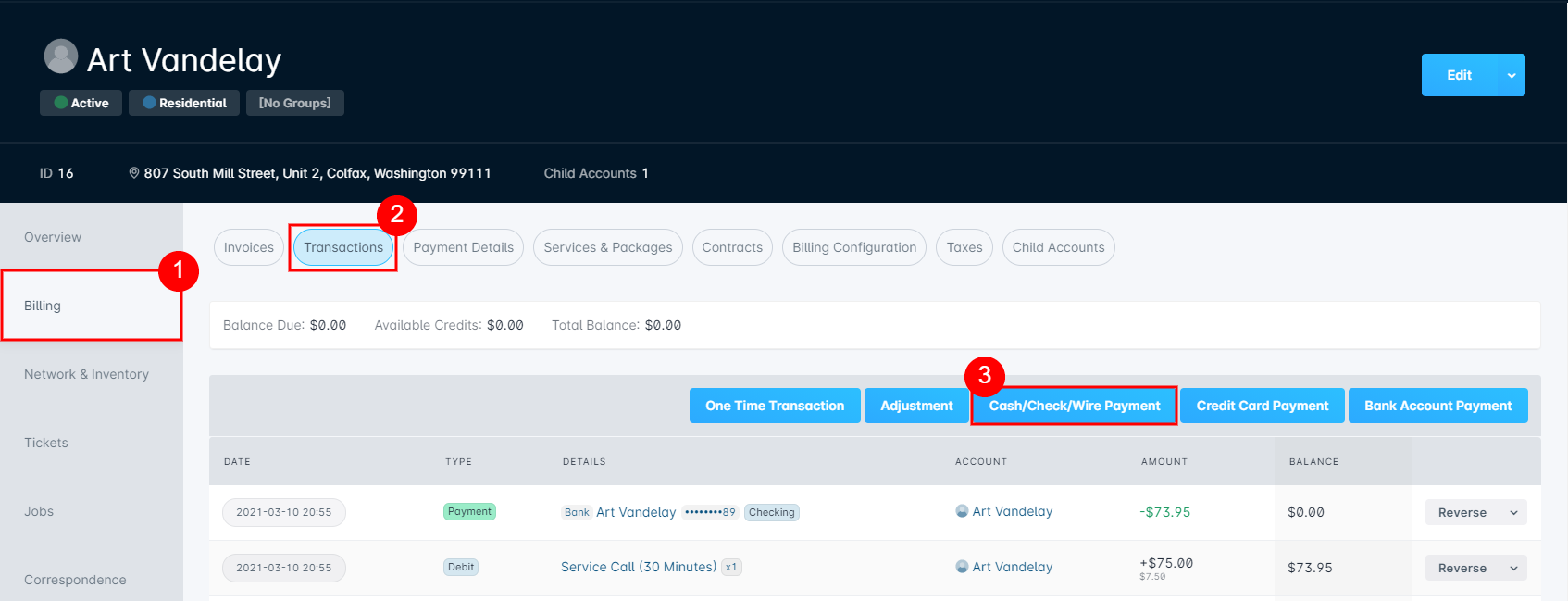

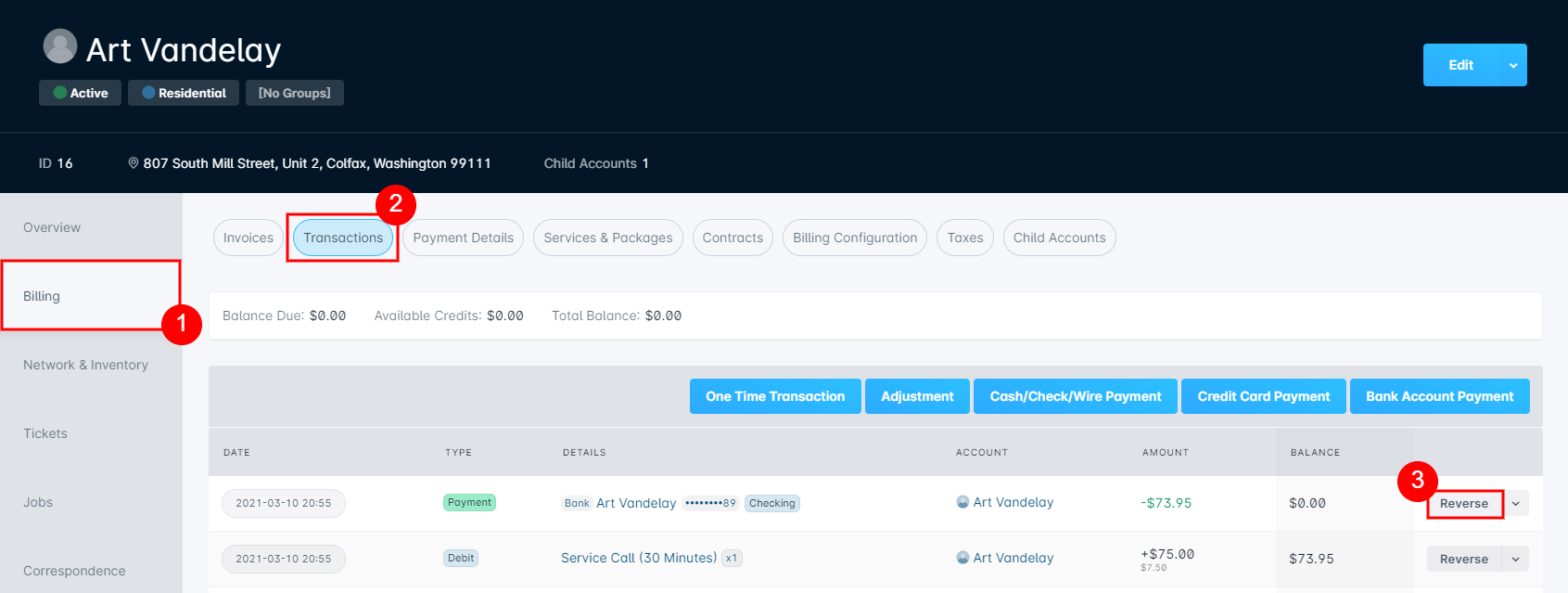

Since Sonar assumes the ACH transaction is valid, if it is not (i.e. a customer had insufficient funds), you will need to manually reconcile this within Sonar. This can be manually reconciled by reversing the customer's payment from within the Transactions sub-tab of their account (available from within the Billing tab); you will not need to perform a refund, since the funds were never actually debited from the customer's bank account.

eCheck

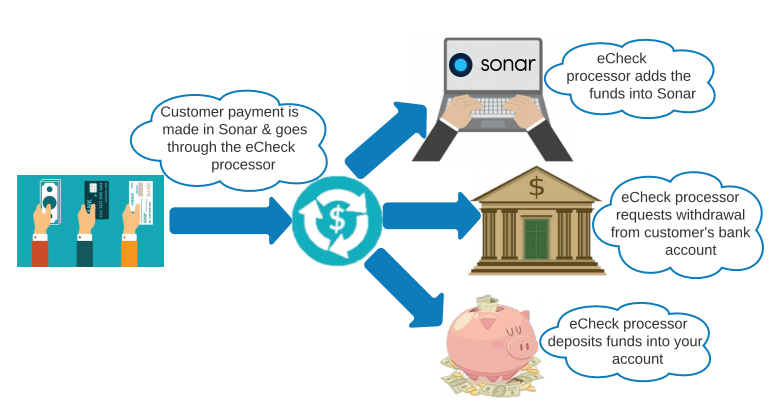

eCheck is a convenient and simple method that allows you to directly debit a customer bank account, similar to when charging a credit card. You can also typically query the merchant gateway for the status of a transaction and reverse any failures, however, this method is generally only supported in the USA and may incur higher fees by your merchant gateway for the service.

How the Money Moves

Considerations

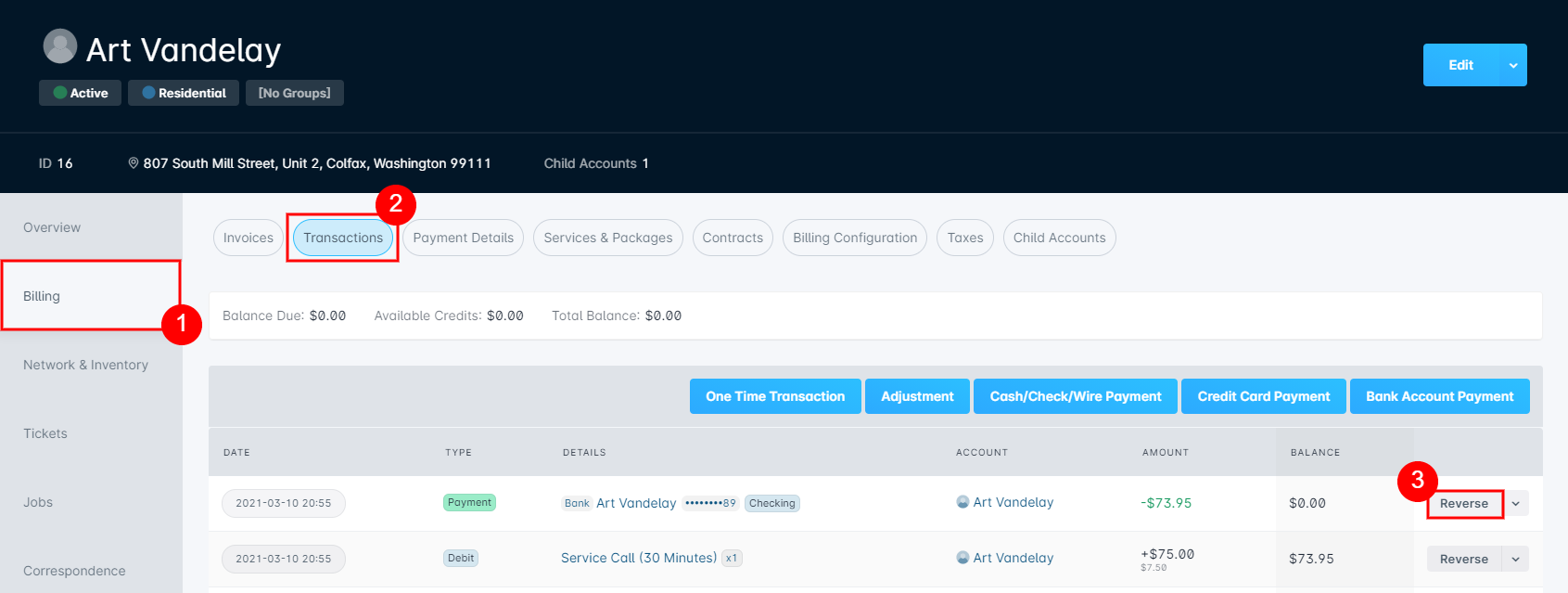

Usually, you are able to query the merchant gateway to confirm a transaction's status and reverse any payments that have failed; however, if this option is not supported or feasible, the reversals will need to happen manually. Customer payments can be manually reversed by using the "Reverse" option for the payment, available through the Transactions sub-tab (within the account's Billing tab). For example, if an eCheck payment initially succeeds, but fails a day or so later as a result of insufficient funds, a reversal would need to be performed for that customer within Sonar; but they will not need to be refunded any money since the payment was not actually made.

Wire

Wire payments are another option that allow you to receive payments from customers into Sonar, and are received almost instantly because there is usually no hold on the received funds, as they are processed by the bank.

How the Money Moves

Considerations

Once the payment has been made, it will need to be manually recorded in Sonar for that customer's account. Due to the nature of wire transfers, you will not run into a situation where insufficient funds cause the payment to fail. However, you could still end up in a situation where a payment was made and received successfully but was not recorded, as a result of human error.

To record a wire payment in Sonar, navigate into the Transactions sub-tab (under the main Billing tab) of a customer's account, click the "Cash/Check/Wire Payment" button, and complete the corresponding fields that appear in the Create Cash/Check/Wire Payment window.